The Exness Calculator is designed to help traders streamline their trading processes by providing instant calculations for key elements like margin, profit, and swap fees. With just a few inputs, you can easily assess your potential trading costs and outcomes before opening a position, allowing for better planning and execution.

Key Features of the Exness Calculator

The Exness Calculator is a versatile and powerful tool designed to help traders manage their trading positions effectively. Here are the key features that make the Exness Calculator essential for both beginner and advanced traders:

Multi-Purpose Calculation Tool

The Exness Calculator provides calculations for essential trading parameters, including margin, profit and loss, and swap fees. This multi-functional capability allows traders to evaluate different aspects of their trades before execution.

Supports a Wide Range of Instruments

The calculator covers a wide variety of trading instruments, including:

- Forex (currency pairs)

- Metals (e.g., gold, silver)

- Indices

- Energies (e.g., oil)

- Cryptocurrencies (e.g., Bitcoin, Ethereum) This broad coverage makes it a useful tool for traders involved in multiple markets.

User-Friendly Interface

Designed to be intuitive and simple to use, the Exness Calculator requires minimal effort to input key parameters and get results instantly. Both new and experienced traders can navigate the interface with ease and obtain the information they need quickly.

Accurate Margin Calculation

The Exness Calculator helps traders determine the exact margin required to open a position. By selecting the instrument, leverage, and position size, traders can instantly see how much capital they need to allocate for each trade.

Profit and Loss Estimation

Traders can easily estimate potential profits or losses by entering the entry and exit prices of their trades. This feature allows for clear planning and more informed decision-making, helping traders set more realistic goals and manage risk better.

Swap Fee Calculation

The calculator also calculates swap fees, which are charged for holding positions overnight. This feature is particularly useful for traders who hold long-term positions and need to account for additional costs.

How the Exness Calculator Works

The Exness Calculator is a powerful yet simple tool that helps traders calculate key trading parameters, such as margin, profit, and swap fees. Here’s a step-by-step guide on how the Exness Calculator works and how you can use it to optimize your trading decisions.

1. Select the Trading Instrument

- Start by choosing the instrument you want to trade. The Exness Calculator supports a wide range of instruments, including Forex currency pairs, metals, indices, cryptocurrencies, and energies.

- For example, if you want to trade EURUSD, select it from the list of available trading instruments.

2. Choose Your Account Currency

- Select the base currency of your trading account. The calculator supports various currencies such as USD, EUR, GBP, etc.

- This ensures that all calculations (margin, profit, swap) are accurately converted into your account’s base currency.

3. Set the Leverage

- Input the leverage you are using for the trade. Leverage allows you to control a larger position with a smaller amount of capital.

- The calculator will adjust the margin requirement based on the leverage you set (e.g., 1:100, 1:500).

4. Enter the Position Size (Lot Size)

- Choose the volume of the trade by entering the lot size. A lot is a standard unit of measurement in trading.

- For instance, entering 1 lot for Forex means controlling 100,000 units of the base currency. You can also enter fractional lot sizes (e.g., 0.1 lot) for smaller trades.

5. Calculating the Margin

- Margin is the amount of money required to open a trade. Once you’ve entered the above parameters (instrument, leverage, and lot size), the calculator will instantly show the margin required for that specific trade.

- This helps you understand how much of your account balance will be reserved for the trade, allowing you to manage your capital efficiently.

6. Estimating Profit and Loss

- The calculator allows you to estimate your profit or loss by inputting the entry and exit prices of your trade.

- By doing so, you can see how much profit you stand to gain or how much you might lose based on the market movement and price levels you set.

- This feature is useful for planning your risk-reward ratio and setting take profit and stop loss levels accordingly.

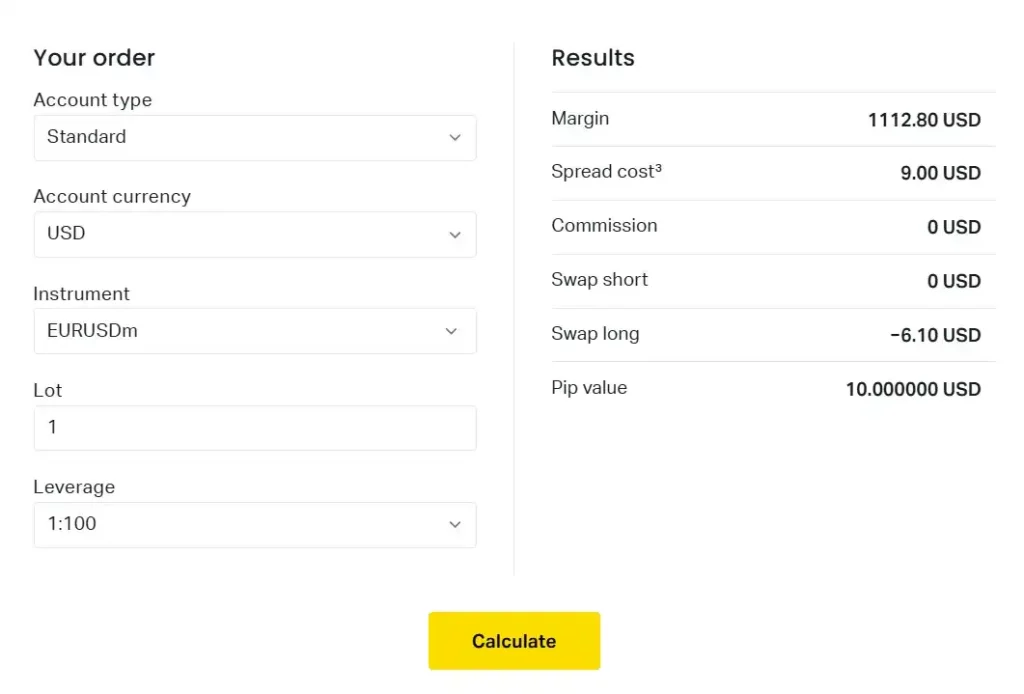

Example of Using the Exness Calculator:

Example 1: Forex Trade (EURUSD)

- Instrument: EURUSD

- Account Currency: USD

- Leverage: 1:100

- Lot Size: 1 lot

Example 2: Cryptocurrency Trade (Bitcoin)

- Instrument: BTCUSD

- Account Currency: USD

- Leverage: 1:10

- Lot Size: 0.5 lots

Benefits of Using the Exness Calculator

The Exness Calculator is a valuable tool that provides traders with multiple benefits, enhancing both trading efficiency and risk management. By simplifying complex calculations, it helps traders make informed decisions. Here are the key benefits of using the Exness Calculator:

Accurate Calculation of Trading Parameters

- The Exness Calculator allows you to accurately calculate essential trading parameters, such as margin requirements, profit and loss, and swap fees. This helps you assess the costs and potential returns of a trade before execution, ensuring no unexpected surprises.

Time-Saving and Efficiency

- Rather than manually calculating margin, swap, and profit for each trade, the Exness Calculator provides instant results. This speeds up your decision-making process, allowing you to focus on strategy and market analysis instead of spending time on repetitive calculations.

Effective Risk Management

- The calculator helps traders manage risk by showing how much capital is required to open and maintain a position. By knowing the exact margin needed, you can avoid over-leveraging your account and minimize the risk of margin calls or forced liquidations.

Informed Profit and Loss Estimation

- By estimating potential profit or loss before executing a trade, the calculator helps you set realistic targets and limits. This is essential for determining your risk-reward ratio, ensuring that you enter trades that align with your financial goals and risk tolerance.

Planning for Overnight Positions (Swap Calculation)

- For traders who hold positions overnight, understanding swap fees is crucial. The Exness Calculator provides the swap rates for each instrument, helping you decide whether holding a trade overnight is cost-effective. This feature is especially useful for long-term traders who want to manage holding costs.

Customizable to Individual Strategies

- The calculator is fully customizable, allowing you to adjust parameters such as leverage, lot size, and entry/exit price. This means you can tailor the tool to fit your specific trading strategy and see how changes to these variables impact the overall trade outcome.

Supports a Wide Range of Instruments

- Whether you trade Forex, metals, indices, cryptocurrencies, or energies, the Exness Calculator supports multiple instruments, providing flexibility for all types of traders. This allows you to get accurate calculations across different markets and asset classes.

FAQ: Exness Calculator

What is the Exness Calculator?

The Exness Calculator is a multi-purpose tool designed to help traders calculate essential trading parameters such as margin requirements, potential profit and loss, and swap fees before executing a trade.