Comparing MT4 Brokers – Choose the Best

Choosing the right broker is essential when using MT4. Even though the platform itself is standard, broker execution speed, pricing, leverage options, and trading instruments can differ significantly. Below is a detailed comparison of some of the most popular brokers offering MT4:

| Commision | Instruments | Min Dep | Regulated By | Leverage | Platforms | ||

|---|---|---|---|---|---|---|---|

| $3.50/lot (Raw) | Forex Stocks Indices | $200 | ASIC CySEC FSA | 1:500 | MT4 MT5 cTrader | ||

| $3.50/lot (Razor) | Forex Commodities ETFs | $200 | ASIC FCA CySEC | 1:500 | MT4 MT5 cTrader | ||

| $0 (Pro) | Forex Stocks Crypto | $10 | IFSC | 1:2000 | MT4 MT5 R StocksTrader | ||

| $0 | Forex Metals Indices | $0 | IFSC CySEC | 1:3000 | MT4 MT5 | ||

| $3.50/lot (Advantage) | Forex Crypto Indices Stocks Commodities | $200 | CySEC FCA FSCA | 1:1000 | FXTM Trader App MT4 MT5 WebTrader | ||

| $0 | Forex Crypto Indices | $25 | CySEC FSC | 1:500 | MT4 MT5 WebTrader Mobile App | ||

| $0 (Ultra Low) | Forex Indices Commodities Stocks Crypto | $5 | ASIC CySEC FSC | 1:1000 | MT4 MT5 XM App | ||

| $0 (Premium) | Forex Commodities | $0 | CySEC FCA DFSA | 1:2000 | MT4 MT5 Web Terminal Multi Terminal | ||

| $2/lot (Raw) | Forex Bonds Indices | $100 | FCA CySEC FSCA | 1:500 | MT4 MT5 | ||

| $3/lot (Raw) | Forex Stocks Metals | $100 | ASIC CySEC FSCA | 1:500 | MT4 MT5 cTrader | ||

| $1.60/lot (ECN) | Forex Crypto | $50 | MISA FSC | 1:3000 | MT4 MT5 | ||

| $3.50/lot (Raw+) | Forex Futures | $100 | FCA CySEC | 1:200 | MT4 MT5 cTrader FxProEdge | ||

| $0 (cost via spreads) | Forex Crypto Commodities Indices | $100 | ASIC CBI FSCA | 1:400 | AvaTradeGO MT4 MT5 |

Let’s take a closer look at each broker to understand how they align with different trading styles and experience levels.

IC Markets

IC Markets

Known for low latency and institutional-grade liquidity, IC Markets pairs well with MT4’s execution engine. The broker’s raw spread account is frequently selected by scalpers. Spreads can go as low as 0.0 pips, with a commission per lot traded. The infrastructure is designed for algorithmic traders who require consistent uptime.

Pepperstone

Pepperstone

Pepperstone brings an ECN-like experience to MT4, offering low spreads and quick execution without minimum deposit requirements. It is regulated in multiple jurisdictions, and clients can access various tools directly integrated with the platform. Ideal for those who need transparency and stable order fills.

RoboForex

RoboForex

RoboForex offers several account types, including those with fixed spreads and commission-free trading. It accommodates both beginners and seasoned traders by allowing small deposits and offering bonuses. MT4 here is optimized for EA usage and includes VPS services to reduce downtime.

FBS

FBS

FBS stands out due to its high leverage and cent account options. This appeals to traders who want to practice live trading with smaller risks. The MT4 terminal includes custom indicators, and its mobile version is lightweight for on-the-go trading.

FXTM Trader

FXTM Trader

FXTM Trader balances flexibility with stability. It allows micro-lot trading and maintains fast trade execution even during high-volume hours. MT4 here includes pre-installed trading tools and economic calendars. The broker also offers educational materials integrated into the trading hub.

Octa

Octa

Octa provides an MT4 environment tailored for those focused on forex and crypto assets. The interface is simplified for ease of use, and execution speeds are decent. While spreads are slightly wider on some pairs, its commission-free model appeals to swing traders and beginners alike.

XM Trading

XM Trading

XM Trading supports multiple MT4 account types with low entry thresholds. The broker is known for its fast order processing and negative balance protection. MT4 is enhanced with proprietary indicators and features like one-click trading. Its educational webinars make it attractive to newer traders.

HFM (HotForex)

HFM (HotForex)

HFM blends tight spreads with account security across its MT4 offering. It allows both fixed and floating spreads, depending on the account selected. VPS services and analytics tools are included. MT4 is compatible with both desktop and mobile, with a focus on execution speed.

Tickmill

Tickmill

Tickmill’s MT4 experience is clean and designed for speed. It’s often chosen by traders who prefer raw spreads and direct market access. No requotes and low latency ensure orders execute accurately. Educational materials are available but not embedded in the platform.

FP Markets

FP Markets

With DMA access and a competitive spread structure, FP Markets is well-suited for traders seeking transparency. MT4 is optimized for VPS usage, and the infrastructure supports automated strategies efficiently. Its integration with trading tools is minimal but functional.

Alpari

Alpari

Alpari offers access to MT4 with account options for micro and standard lot sizes. Traders can start with minimal deposits. It’s common among those who trade forex and crypto due to its straightforward conditions. Signal trading and EAs are also supported.

FXPro

FXPro

FXPro provides rich liquidity and stable connectivity for MT4 users. It runs on a no-dealing-desk model, and execution is smooth even in volatile markets. It’s used widely by those who incorporate technical analysis tools and scripting via MQL4.

AvaTrade

AvaTrade

AvaTrade brings stability to MT4 with a focus on risk control. Fixed spread accounts are available for those who want to limit variable costs. The platform includes educational widgets and supports mobile use across Android and iOS.

What is MetaTrader 4 (MT4)?

MT4 is a trading platform that changed how retail traders approach the markets. It delivers stability, precision, and the ability to implement both manual and automated strategies. Developed in 2005, it remains relevant due to its clear interface, deep customization options, and lightweight system requirements.

A Trusted Platform for Traders of All Levels

MT4 became widely adopted due to its universal compatibility and consistent performance. Beginners use it to study charts and test basic indicators. More experienced traders deploy Expert Advisors (EAs), custom scripts, and indicators for automated decision-making. Brokers continue to support it because of its reliability, even under extreme market conditions.

Why traders continue to use MT4:

- Ease of Use – Simple layout with clearly labeled functions.

- Speed – Low system resource usage, quick execution.

- Custom Tools – Thousands of indicators and EAs available.

- Multi-Asset Support – Access to currency pairs, metals, indices, and more.

- Security – End-to-end encryption and two-factor authentication options.

Its design makes it suitable for both discretionary trading and systematic strategies. The user interface does not require prior programming experience, yet advanced features remain available for those who need deeper control.

Key Features That Make MT4 Stand Out

Several characteristics distinguish MT4 from other trading software. While newer platforms exist, MT4 holds its ground thanks to a practical mix of reliability and functionality.

| Feature | Description |

| Custom Indicators | Users can import or develop their own using the MQL4 language |

| Chart Timeframes | 9 timeframes per symbol — from 1 minute to 1 month |

| Pending Orders | 4 types of pending orders with adjustable expiration times |

| One-Click Trading | Execute trades directly from the chart window |

| Market Depth (Level II) | Displays liquidity when supported by the broker |

| VPS Compatibility | For automated strategies requiring 24/7 operation |

| Integrated News Feed | Real-time financial news within the terminal |

Additional capabilities worth noting:

- Multiple order types including stop-loss and take-profit.

- Built-in strategy tester for backtesting EAs.

- Option to import historical data.

- Alerts via email, push notification, or sound.

While MT4 does not support multiple asset classes as deeply as newer platforms like MT5, it covers forex and CFD trading efficiently, with broad broker compatibility.

How to Download MT4 for Free

The software is completely free when obtained via a regulated broker. Most brokers provide dedicated download pages tailored to their infrastructure. It’s important to download the version specific to the broker to avoid login issues or missing server connections.

MT4 for Windows

The Windows version is the most widely used and fully featured. It includes all indicators, EAs, and charting capabilities.

Steps to download and install MT4 for Windows:

- Visit your broker’s MT4 download page.

- Click the download button and run the .exe file.

- Follow the installation wizard.

- Launch the terminal and log in with your broker credentials.

Minimum OS: Windows 7 or later (64-bit preferred)

File size: ~12–20 MB

Installation time: Under 3 minutes on most systems

MT4 for macOS

macOS support depends on the broker. Some offer native apps, others use emulation software (like Wine or PlayOnMac). While performance is mostly comparable, certain features may be limited without additional setup.

To install MT4 on Mac:

- Option 1: Use a broker offering a pre-packaged macOS installer.

- Option 2: Use Wine to run the Windows installer on Mac.

- Option 3: Set up a VPS or use WebTrader to bypass installation entirely.

⚠️ Not all custom indicators are guaranteed to work on macOS without adjustmen

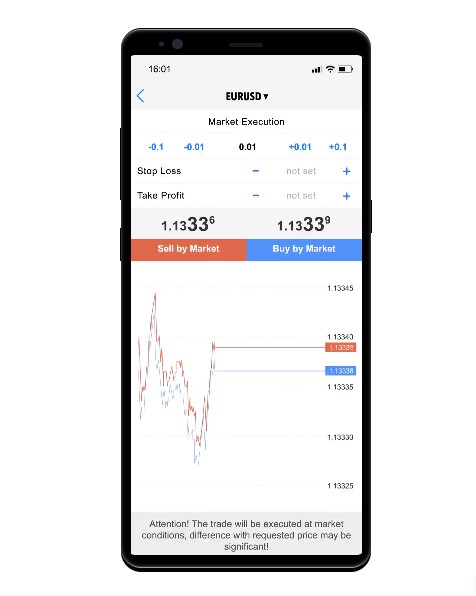

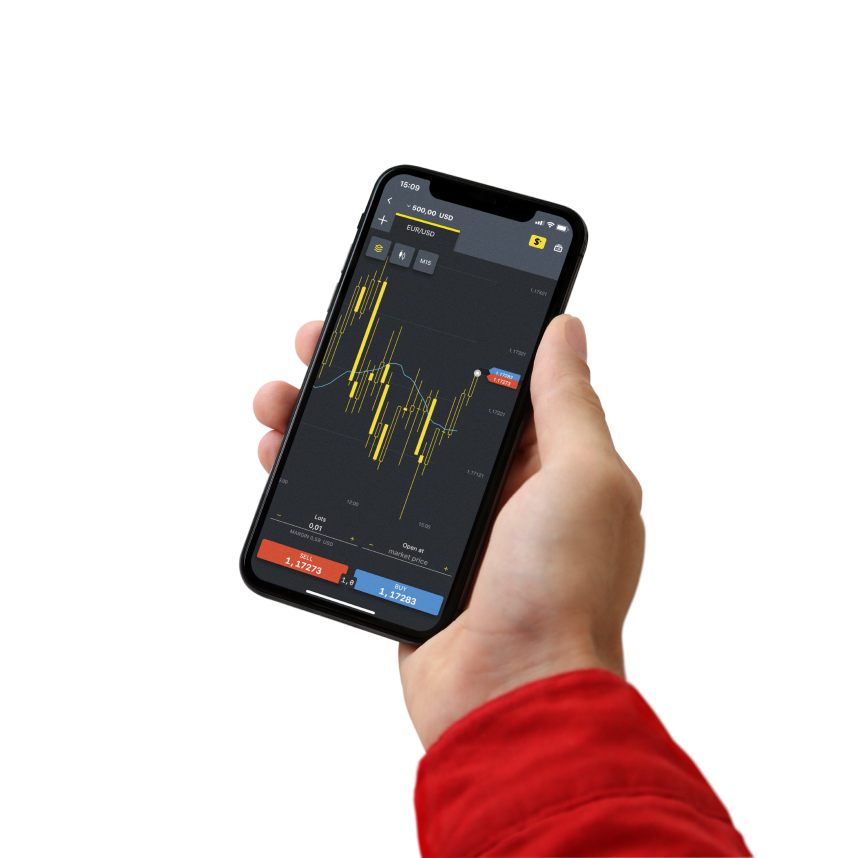

MT4 Mobile App (Android & iOS)

For mobile trading, the official MT4 app is available on Google Play and the Apple App Store. It’s developed by MetaQuotes and functions independently of brokers (login credentials link you to your broker’s server).

What you can do on the mobile app:

- Monitor prices in real-time

- Open and close positions

- Add basic indicators

- Use one-click trading

- Receive push notifications

Limitations of the mobile version:

- Fewer chart types and no custom scripts

- No backtesting tools

- Limited workspace compared to desktop

However, for trade management on the go, it’s reliable and efficient.

MT4 WebTrader – Trade Without Installing Software

WebTrader runs entirely in the browser. It’s useful for those who trade on public or restricted devices where software installation is not permitted.

Key functions available in WebTrader:

- Real-time quotes and execution

- Market and pending orders

- Chart drawing tools

- Basic indicators

- History and journal logs

Compatible browsers:

- Google Chrome

- Mozilla Firefox

- Safari

- Microsoft Edge

WebTrader is often seen as a backup solution but works smoothly in most environments.

MT4 Download Options Comparison

| Platform | Full Feature Access | Custom Indicators | Installation Required | Suitable For |

| Windows | ✅ Yes | ✅ Yes | ✅ Yes | All types of traders |

| macOS (Native) | ⚠️ Partial | ⚠️ Limited | ✅ Yes (or via Wine) | Mac users with basic needs |

| Mobile (iOS/Android) | ⚠️ Partial | ❌ No | ✅ Yes (via App Store) | On-the-go trading |

| WebTrader | ⚠️ Partial | ❌ No | ❌ No | Quick access, backup |

How to Install and Set Up MT4

Setting up MT4 takes only a few minutes but proper configuration ensures smoother operation and faster access to market data. Each step — from installation to chart personalization — can influence trading decisions and reduce technical friction.

Installation Process (Step-by-Step)

Correct installation is essential to avoid server errors or unstable behavior. It’s advised to always download the terminal from the broker’s official site.

Step-by-step instructions for installing MT4 on Windows:

- Download the Installer: Visit the broker’s official MT4 section and download the .exe file.

- Run the Installer: Launch the downloaded file. A standard installation wizard will appear.

- Choose Installation Path (Optional): Select a folder for installation if needed. By default, it installs in C:\Program Files (x86).

- Complete Installation: Click “Next” and wait for the files to unpack. The process takes 1–2 minutes.

- Launch Terminal: After completion, the terminal opens automatically. If not, use the desktop shortcut.

Quick checklist before launching:

- Ensure firewall permissions are granted.

- Allow the application to access the internet.

- Disable antivirus blocking if login fails.

Once installed, the terminal should detect available trading servers and prompt for login credentials.

Logging Into Your Trading Account

To access live or demo accounts, a valid login and server address are required. These are provided by the broker after registration.

How to log in:

- Open MT4 and click File → Login to Trade Account.

- Enter: Account number, Password, Broker’s server name.

- Click Login

A successful connection will be indicated in the bottom-right corner of the platform, showing current ping and data flow.

Troubleshooting login issues:

- Incorrect server selection is the most common cause of failure.

- Passwords are case-sensitive.

- Demo accounts may expire after inactivity.

Choosing and Customizing Your Charts

By default, MT4 opens with four basic chart windows. Customization helps improve visibility and speed up analysis.

Recommended chart setup steps:

- Change Color Scheme: Right-click the chart → Properties → Colors tab. Choose black background for better contrast, or white for printing.

- Apply Template: Configure your favorite indicators and timeframes, then save as a template: Right-click chart → Template → Save Template

- Add Indicators: Use the Navigator panel or top menu to drag indicators onto the chart. Common ones include: Moving Average (MA), Relative Strength Index (RSI), Bollinger Bands.

- Enable Grid or Remove It: Ctrl + G toggles grid visibility for cleaner charts.

- Set Default Chart: Save your layout and indicators as a template called default.tpl — this will load automatically every time you open a new chart.

Quick Chart Settings

| Function | How to Access | Shortcut / Location |

| Change Timeframe | Toolbar or Right-click on Chart | M1, M5, M15, H1, H4, D1, W1, MN |

| Add Indicator | Navigator panel or Insert → Indicators | Drag & drop |

| Save Layout Template | Right-click chart → Template | Save/Load |

| Change Chart Type | Toolbar icons | Bar, Candle, Line |

| Switch Chart | Click tab at bottom of chart area | No shortcut |

Chart personalization is often underestimated, but consistent formatting reduces reaction time during live trading. Experienced traders use specific color codes for candle types and signals.

Additional Pro Tips:

- Detach chart windows for multi-monitor setups via “Window → Tile Windows.”

- Lock charts in position to avoid accidental scrolling.

- Use “Auto Scroll” and “Chart Shift” toggles for better viewing of price action.

Why Trade on MT4?

MetaTrader 4 continues to be a preferred trading platform across all experience levels. Its consistent performance during high market volatility, extensive technical tools, and strong automation capabilities keep it relevant, even as newer platforms emerge. MT4 simplifies market interaction without compromising on functionality.

Fast Execution and Reliable Performance

Order execution speed is a critical factor in live trading. MT4 is designed to process orders rapidly, minimizing slippage during high-impact events or volatile sessions. The terminal supports different execution models to suit various broker infrastructures.

Order execution types supported in MT4:

| Execution Type | Description |

| Instant Execution | Executes at the quoted price or rejects the order if price changes |

| Market Execution | Executes at the best available market price |

| Pending Orders | Includes Buy Limit, Sell Limit, Buy Stop, and Sell Stop |

| One-Click Trading | Enables quick execution directly from chart |

The lower right corner of the platform shows real-time server connection, ping, and data flow — useful for identifying delays or connectivity issues.

Advanced Charting and Technical Indicators

MT4 offers robust charting functionality with built-in indicators and tools for detailed analysis. Whether using a single screen or multi-monitor setup, users can configure charts to fit specific trading strategies.

Charting tools in MT4 include:

- 30+ built-in indicators

- 24 analytical tools (trendlines, channels, Fibonacci)

- 9 timeframes per asset

- 3 chart types: Candlestick, Bar, Line

- Multiple chart templates and saved layouts

Most commonly used indicators:

- Moving Average (MA)

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Bollinger Bands

- Stochastic Oscillator

Custom indicators in MQL4 can also be added, allowing for personalized setups that align with specific technical systems.

Automated Trading with Expert Advisors (EAs)

One of the standout features of MT4 is the ability to run Expert Advisors — programs that trade automatically based on coded logic. These tools reduce the need for manual input and ensure consistency across trades.

Key EA functionalities:

- Entry and exit management

- Automated risk settings

- Scheduled trading hours

- Instant reaction to price movements or signals

Steps to enable automated trading:

- Add the EA file to the /Experts folder in the platform directory

- Restart MT4

- Drag the EA onto the chart

- Enable “AutoTrading” from the top toolbar

Traders can also use the built-in Strategy Tester to run historical backtests and optimize EA parameters before applying them live.

Secure and Stable Platform for Everyday Trading

Security in MT4 is multi-layered. All data transfers are encrypted using SSL protocols, and account logins are split between master and investor passwords. This structure enables traders to share monitoring access without allowing trade execution.

Key security measures:

- Encrypted connections to broker servers

- Investor (read-only) and master (full-access) account separation

- Automatic logout on inactivity

- Journal logs for all system actions

MT4’s stability is another strength. It operates efficiently on low-spec systems and rarely crashes, even under load. Updates are minimal and do not interfere with active sessions.

MT4 vs. Other Trading Platforms – Performance Comparison

| Feature | MetaTrader 4 | Alternative Platforms (e.g. cTrader) |

| Automated Trading (EAs) | ✅ Fully supported | ⚠️ Limited integration |

| Custom Indicators | ✅ MQL4 ecosystem | ⚠️ Smaller library |

| System Requirements | ✅ Low | ❌ Higher |

| Broker Availability | ✅ Widespread | ⚠️ Selective |

| Community Resources | ✅ Active | ⚠️ Moderate |

While other platforms offer more complex interfaces or additional asset classes, MT4 continues to excel in reliability and practical use cases.

What Can You Trade on MT4?

MetaTrader 4 supports a broad set of asset classes through Contracts for Difference (CFDs). Depending on the broker, traders can access not only major forex pairs but also metals, energy commodities, stock indices, equities, and even cryptocurrencies. The instruments are streamed in real-time and can be executed manually or through automation.

Forex Currency Pairs

Foreign exchange remains the primary asset class on MT4. Most brokers offer dozens of currency pairs, from majors to exotics. Real-time spreads, leverage settings, and swap rates are all accessible from the Market Watch window.

Forex categories typically available:

- Majors – EUR/USD, GBP/USD, USD/JPY, USD/CHF

- Minors – EUR/GBP, AUD/CAD, NZD/JPY

- Exotics – USD/TRY, EUR/SEK, USD/ZAR

Why forex on MT4 is efficient:

- Tight spreads on major pairs

- High leverage options (1:30 up to 1:2000 depending on regulation)

- 24/5 market access

- One-click trading and rapid execution

Brokers often include integrated calculators for pip value, margin requirements, and swap cost — all accessible within the trading panel.

Precious Metals and Commodities

Gold and silver are the most traded commodities on MT4. Many brokers also offer CFDs on oil (WTI/Brent) and natural gas, especially for swing traders and macro-focused strategies.

Common instruments:

- XAU/USD (Gold)

- XAG/USD (Silver)

- UKOIL (Brent Crude)

- USOIL (WTI Crude)

- NATGAS (Natural Gas)

Trading commodities via MT4:

- Charts behave like currency pairs

- Some instruments follow different trading hours (e.g. oil CFDs)

- Swaps and margin requirements vary significantly by asset

Due to their volatility, these assets often require stricter risk management, which can be automated using Expert Advisors or manual stop settings.

Indices and Stocks

Stock indices give traders exposure to broader market sentiment. MT4 supports major global indices as well as single stock CFDs. While MT4 wasn’t originally designed for equities, brokers have extended support using custom symbol feeds.

Indices often available on MT4:

- US30 (Dow Jones)

- NAS100 (Nasdaq 100)

- SPX500 (S&P 500)

- GER30 (DAX)

- UK100 (FTSE 100)

Stocks include:

- AAPL, AMZN, MSFT (US tech stocks)

- TSLA, META, JPM (large caps)

- European equities (when broker supports local markets)

What to consider:

- Stock trading may have tighter session windows (US open/close)

- Dividend adjustments can affect positions

- Leverage on stocks is often capped (1:5 to 1:20)

Not all brokers offer stock CFDs on MT4. Those that do typically limit the selection to the most liquid symbols.

Cryptocurrencies

Some MT4 brokers support digital assets, though not all. These are also traded as CFDs, which means no need to open a crypto wallet or own the underlying coin.

Popular crypto pairs on MT4:

- BTC/USD

- ETH/USD

- XRP/USD

- LTC/USD

- BCH/USD

Features of crypto trading on MT4:

- 24/7 trading access (broker-dependent)

- Higher spreads due to volatility

- No wallet required, settled in fiat currencies

- Leverage typically ranges from 1:2 to 1:20

Cryptocurrencies on MT4 function like any other CFD product — orders, stop levels, and charting tools remain consistent.

Asset Class Availability on MT4

| Asset Class | Available on MT4 | Typical Leverage | Trading Hours |

| Forex | ✅ Yes | Up to 1:2000 | 24/5 |

| Commodities | ✅ Yes | Up to 1:100 | Varies by instrument |

| Indices | ✅ Yes | Up to 1:500 | Based on market sessions |

| Stocks (CFDs) | ⚠️ Limited | Up to 1:20 | Exchange hours |

| Cryptocurrencies | ⚠️ Broker-specific | Up to 1:20 | Often 24/7 |

MT4 System Requirements and Compatibility

MetaTrader 4 is known for its efficiency and lightweight footprint. Unlike some newer platforms, it doesn’t require advanced hardware or complex configurations. Even on older systems, MT4 runs smoothly — which is one reason for its long-standing popularity among traders in all regions.

Minimum Hardware Specifications

While MT4 can operate on minimal resources, traders using multiple indicators or Expert Advisors should aim for slightly higher specs to avoid lag or chart freezing.

Recommended minimum setup:

| Component | Minimum Requirement | Recommended for Stability |

| CPU | 1 GHz single-core | 2 GHz dual-core or higher |

| RAM | 512 MB | 2 GB or more |

| Disk Space | 50 MB for installation | 250 MB free for data and logs |

| Screen Resolution | 1024 x 768 | 1920 x 1080 |

| Internet Speed | 128 kbps | 1 Mbps or higher |

Performance tips:

- For EAs or VPS usage, prioritize RAM and CPU performance.

- Keep logs and historical data cleared regularly to prevent bloated memory usage.

- Avoid running other heavy programs alongside MT4 if system specs are low.

Supported Operating Systems

MetaTrader 4 is primarily built for Windows but can be used on other platforms with workarounds or emulation software. Mobile versions are also widely available and offer sufficient control for most non-technical functions.

Desktop OS compatibility:

- Windows: Full support for Windows 7, 8, 10, and 11

- macOS: Requires Wine, PlayOnMac, or custom broker packages

- Linux: Runs using Wine (not all features guaranteed)

Mobile OS compatibility:

- Android: Android 5.0 and above

- iOS: iOS 11.0 or later (iPhone/iPad)

Platform Compatibility

| Platform | Supported? | Full Features Available? | Notes |

| Windows | ✅ Yes | ✅ Yes | Best performance and full compatibility |

| macOS (via Wine) | ⚠️ Partial | ⚠️ Some limitations | May lack support for certain EAs or indicators |

| Linux | ⚠️ Partial | ❌ Limited | Installation via Wine, unstable for live trading |

| Android | ✅ Yes | ⚠️ Limited charting tools | Good for monitoring, not for heavy analysis |

| iOS | ✅ Yes | ⚠️ No custom indicators | Fast and stable, but no custom script support |

Frequently Asked Questions

Why can’t I log in to my MT4 account?

Most login errors come from using the wrong server or entering incorrect credentials. It’s important to double-check the account number, password, and server name exactly as provided by your broker. Demo accounts that have been inactive for too long may also expire.